What is Prologis?

According to its 2023 annual report, “Prologis is the global leader in logistics real estate with a focus on high-barrier, high-growth markets.” The logistics real estate sector provides warehouse distribution and fulfillment centers to streamline supply chains and meet the demands of both traditional and online commerce. Prologis develops and manages these centers in 19 countries and four continents. According to the Prologis website, about 2.8% of the world’s GDP channels through their distribution centers annually.

Prologis is a REIT which means that it is required to distribute at least 90% of its taxable income as dividends. It operates two segments: the real estate segment and a much smaller strategic capital segment. The real estate segment comprises rental operations, which generate rental income from existing facilities and development. Prologis uses its land assets and construction expertise to build facilities for clients. The leases are generally long-term (average term of 66 months), providing a steady rental income stream. The strategic capital segment involves partnerships with institutional investors to develop and manage properties.

Financial Results:

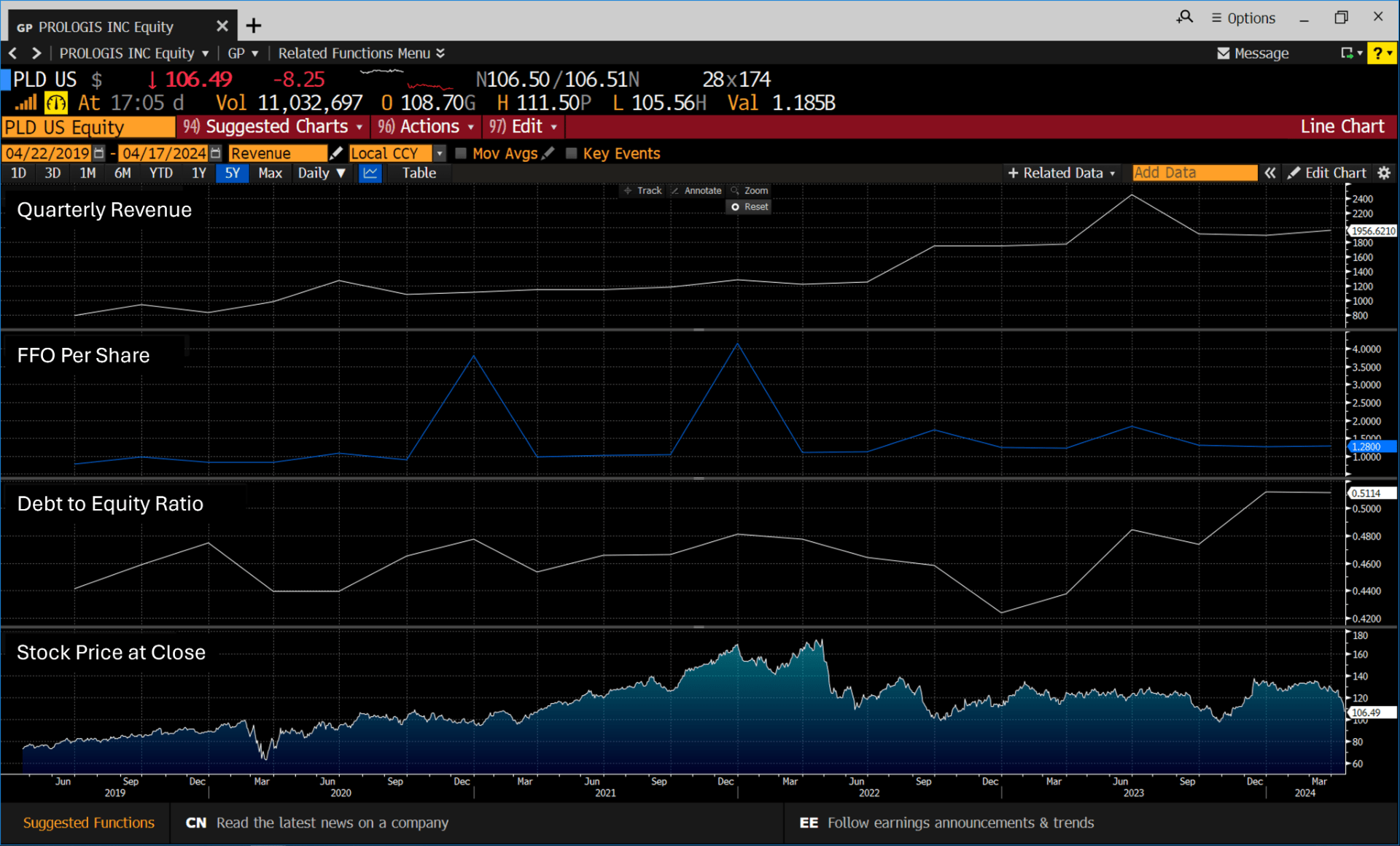

As shown in the top panel below, Prologis’ revenue has nearly doubled since 2020. This is driven partly by organic growth and partly by acquisitions (including a $21bln purchase of Duke Realty in 2022). Fueling organic growth is Prologis’ ability raise prices on its customers. REIT performance is generally measured using funds from operations (FFO) which measures cash generated from regular operations. The second panel from the top shows that Prologis FFO per share jumped from $3.80 in the FY ending December 2020 to $5.61 in December 2023 . Regarding its balance sheet, Prologis’s expansion was associated with an increase in debt, but its debt-to-equity ratio only increased from 0.44 to 0.51. Finally, the stock price doubled in the last five years, as seen in the bottom panel of the image below, pushing the market cap to $128bln. Including dividends, the total annual return on the stock was 14.5% since 2020. The current dividend yield is around 3%.

Investment Thesis:

There are four components to our investment thesis. First, we believe the market underestimates the value of Prologis’ uniquely positioned assets in high-demand, high-barrier-to-entry geographies. We believe the demand for logistics services, warehouses, and distribution centers in these areas will continue growing faster than the market expects. Second, Prologis’ global footprint and relationships with key customers ensure its sector dominance – a point that is currently underappreciated by the market as evidenced by similar multiples applied to Prologis’ much smaller rivals. Third, Prologis has a significant opportunity to convert some of its locations into data centers – an opportunity that is particularly attractive when combined with its focus on using solar energy. Finally, given uncertainty about future inflation, Prologis’ ability to raise rents in line with inflation and ownership of real assets will serve as a long-term hedge against inflation.

Valuation:

The table presented above shows Bloomberg’s relative valuation of Prologis. It appears that Prologis’ price to funds from operations (P/PFFO) at different horizons (blended forward, FY1 and FY2) are only slightly higher than its peers, and its blended forward price to earnings ratio (BF P/E) is slightly lower than that of its peers. The two year average of these metrics is between 7% and 16% lower than current multiples. We note, however, that Prologis boasts a market capitalization about ten times larger than its largest competitor. We argue that these much smaller companies and not entirely appropriate comparables. Part of our investment thesis is that Prologis should be valued at a higher multiple than logistics companies that lack Prologis’s scale and global footprint.

ESG:

Prologis has very attractive ESG (environmental, social and governance) characteristics. In particular, it has implemented energy-efficient building designs, renewable energy installations, and initiatives to reduce water usage and waste generation. The potential to cover the roofs of its warehouses and distribution centers with solar panels is enormous. These efforts align with global sustainability goals and contribute to cost savings and operational efficiency over the long term. On the social front, Prologis prioritizes community engagement, diversity, equity, and inclusion. Prologis Bloomberg Overall ESG score has nearly doubled over the last six years.

written by Dionis Polanco (’24) , Matt Adner (’26), and Luke McVeigh (’26) with assistance from Tomas Dvorak