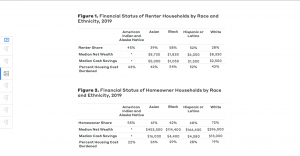

Safe and affordable housing is a primary concern to almost every single person living in the United States. However, there are many disparities in the current housing system in the United States that reveal deeper levels of racism and discrimination. As the graphs below show, the financial status and net worth of different races are shown. The important thing to understand is that while financial status is the here and now, net worth is even more important since that becomes generational wealth for the future. Nationally, black households only earned 61 cents per $1 of white households. This disparity significantly affects the ability to afford housing and this form of racism persists over generations. A black family is 16 times more likely than white families to experience 3 generations of poverty. Even when both races make similar poverty-level wages, white households have an average net worth of $18,000 in savings while black families have either no savings or negative. These racial disparities all play into housing issues. When the recession hit in 2008, black and hispanic families that were approved for loans were 2.4 times more likely to receive a subprime(loans for people deemed to have difficulty paying back a loan) than white families. Income and net worth are massive factors pertaining to housing and the differences between races in these areas emphasize racial discrimination that heavily affects non-white households’ ability to own a home and secure money for themselves and future generations.

Works Cited:

https://bipartisanpolicy.org/report/understanding-and-addressing-racial-and-ethnic-disparities-in-housing/

https://www.americanprogress.org/article/systemic-inequality-displacement-exclusion-segregation/